Exploring Flexible Payment Options for Watches

Introduction to Flexible Payment Options for Watches

In today’s fast-paced world, owning a stylish and functional watch is more than just a time-keeping necessity; it’s a statement of personal style and sophistication. However, the price of high-quality watches can sometimes be a barrier. Fortunately, the rise of flexible payment options has made it easier than ever to own a watch without financial strain. This article explores various payment methods available to consumers, ensuring that purchasing a watch is both affordable and convenient.

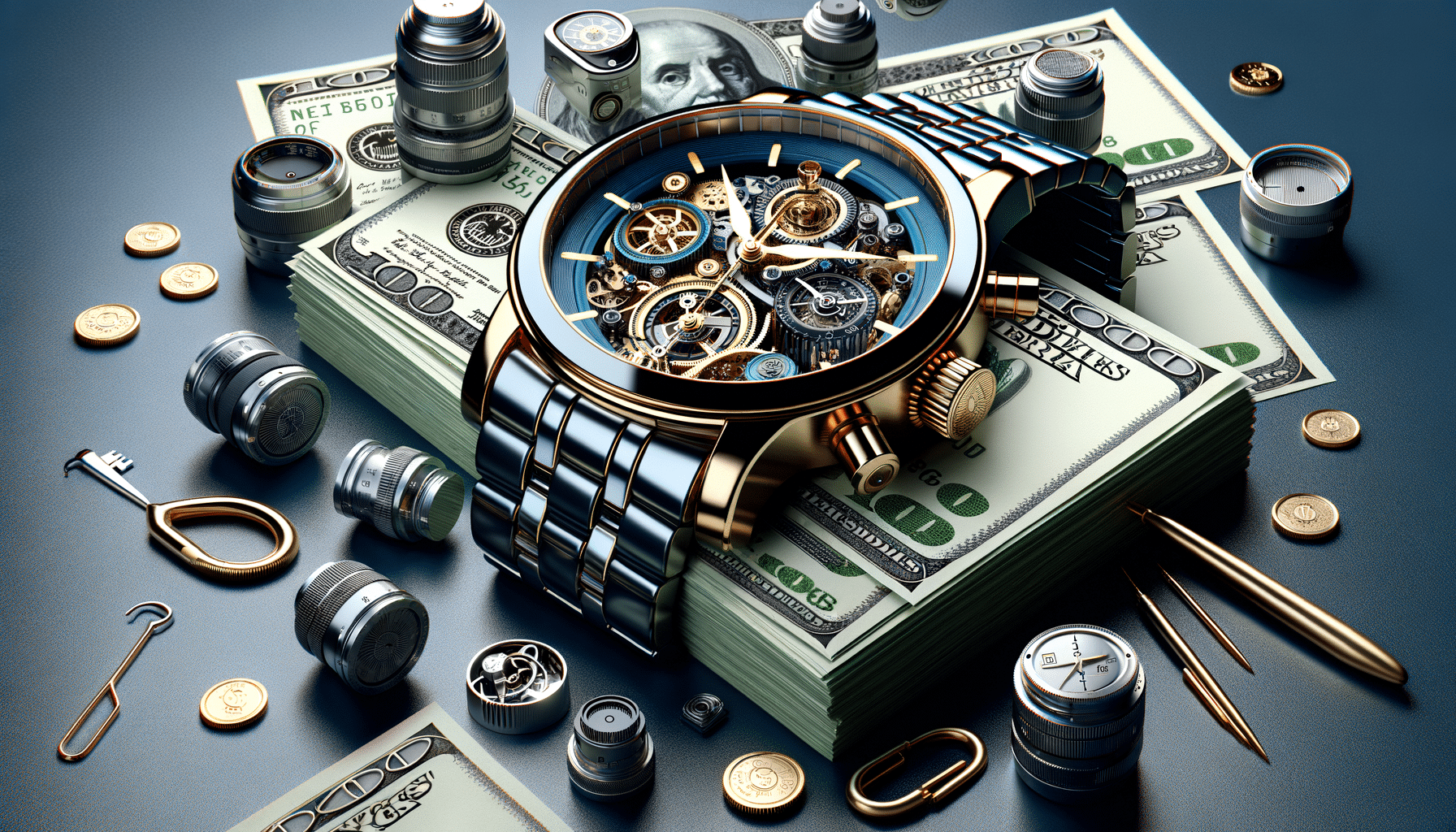

Traditional Payment Methods

Traditionally, buying a watch involved a straightforward transaction: pay the full price upfront and take your watch home. This method remains popular for those who prefer to avoid debt or interest payments. Paying upfront often comes with benefits such as discounts or additional warranties.

However, not everyone has the means to make a large one-time payment. For these individuals, traditional methods may not be the most feasible option. This is where alternative payment solutions come into play, offering a more manageable approach to purchasing luxury items.

Installment Plans

Installment plans are a popular choice for consumers who wish to spread the cost of their purchase over time. This method allows buyers to pay for their watches in monthly installments, often with little to no interest. These plans are usually offered directly by the retailer or through third-party financial services.

Benefits of installment plans include:

- Predictable monthly payments

- Ability to own a watch sooner without saving up the full amount

- Potential for interest-free periods

It is important to read the terms and conditions carefully, as some plans may include hidden fees or penalties for late payments.

Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later (BNPL) services have surged in popularity, providing consumers with another flexible payment option. These services allow customers to receive their watch immediately while paying for it over a set period. BNPL services are particularly appealing to younger consumers who prefer the convenience and flexibility they offer.

Key features of BNPL services include:

- No upfront payment required

- Flexible repayment schedules

- Minimal or no interest charges

However, it’s crucial to manage payments responsibly, as missing payments can lead to penalties and affect credit scores.

Credit Card Financing

Using a credit card to finance a watch purchase is another viable option. Many credit cards offer introductory 0% APR periods, allowing consumers to pay off their purchase without accruing interest. Additionally, credit cards often come with rewards programs, providing cashback or points for purchases.

When considering credit card financing, it’s essential to:

- Be aware of the interest rate after the introductory period

- Make at least the minimum payment each month to avoid fees

- Utilize rewards programs to maximize benefits

Credit card financing can be an excellent option for those who can manage their payments effectively and take advantage of the benefits offered.

Conclusion: Choosing the Right Payment Option

When it comes to purchasing a watch, the variety of payment options available ensures that there is a solution for every financial situation. Whether you prefer the simplicity of paying upfront, the flexibility of installments, or the convenience of BNPL services, it’s crucial to choose a method that aligns with your financial goals and lifestyle. By understanding the benefits and potential drawbacks of each option, you can make an informed decision that allows you to enjoy your new watch without financial stress.