Exploring Buy Now, Pay Later Options for Electric Cars

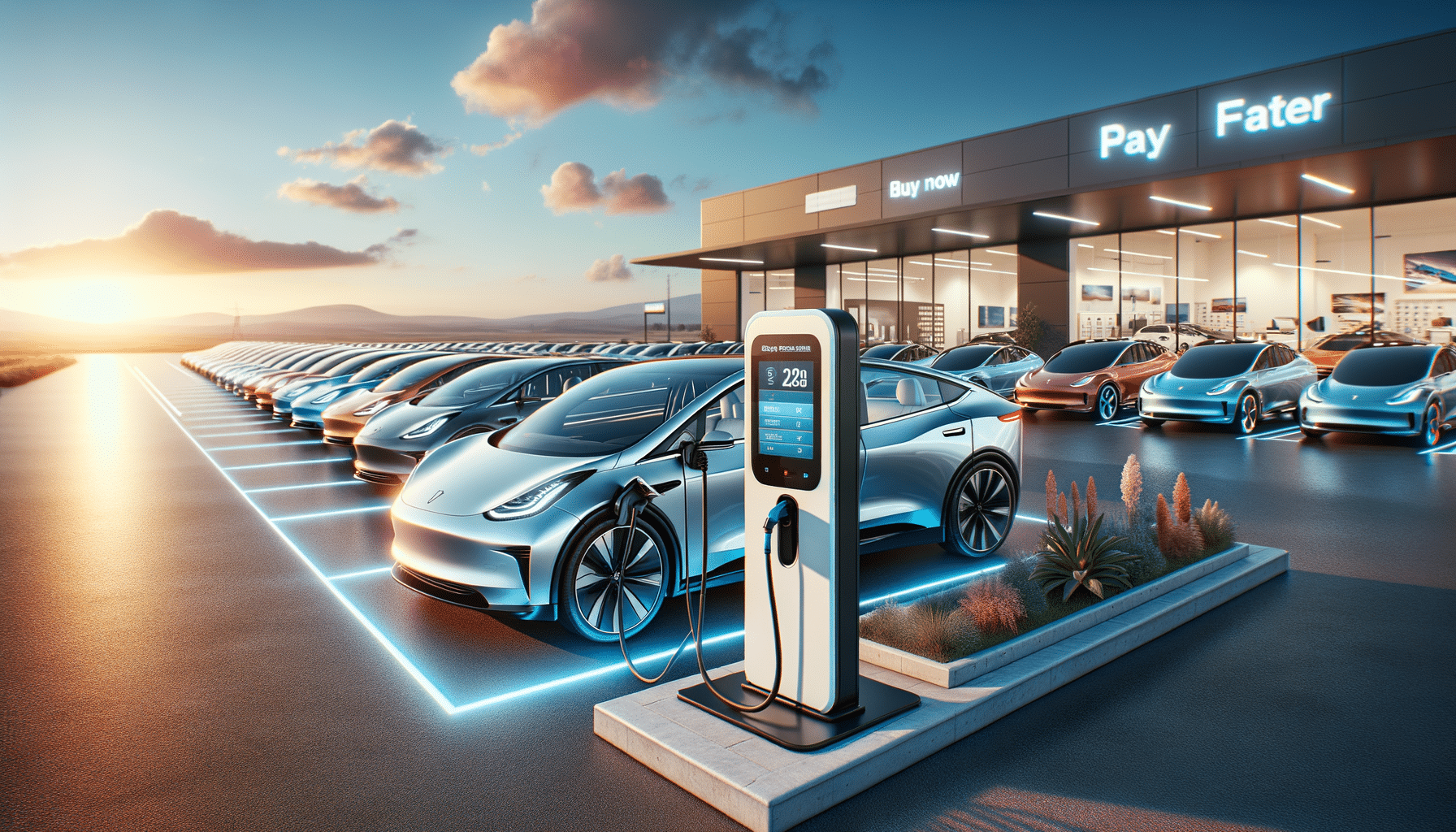

Introduction to Buy Now, Pay Later for Electric Cars

As the world shifts towards more sustainable modes of transportation, electric cars have emerged as a popular choice for eco-conscious consumers. However, the upfront cost of these vehicles can be a barrier for many. This is where the concept of “Buy Now, Pay Later” (BNPL) comes into play, offering a flexible financial solution for potential buyers. By spreading the cost over time, BNPL makes it easier for consumers to transition to electric vehicles without the burden of immediate full payment.

Understanding the Buy Now, Pay Later Model

The Buy Now, Pay Later model allows consumers to purchase a product and defer payment over a specified period. This model has gained traction in various sectors, including retail and electronics, and is now making its way into the automotive industry. For electric cars, BNPL can be structured in several ways, such as interest-free installments or low-interest financing options. This flexibility helps to make electric vehicles more accessible to a broader audience.

Key benefits of the BNPL model include:

- Immediate access to the vehicle without full payment upfront.

- Flexible payment schedules that can be tailored to the buyer’s financial situation.

- Potential for zero or low-interest rates, reducing the overall cost of ownership.

Advantages of BNPL for Electric Cars

One of the primary advantages of the BNPL model for electric cars is the ability to drive a vehicle without the initial financial strain. This can be particularly appealing to younger consumers or those with limited savings. Additionally, BNPL options often come with the benefit of predictable monthly payments, allowing buyers to budget more effectively.

Furthermore, some BNPL plans may include maintenance packages or extended warranties, providing added peace of mind to new electric car owners. This comprehensive approach not only makes the financial aspect more manageable but also enhances the overall ownership experience.

Challenges and Considerations

While the BNPL model offers numerous benefits, potential buyers should be aware of certain challenges. For instance, missing a payment can lead to penalties or increased interest rates, which can negate the initial savings. It is crucial for consumers to thoroughly understand the terms and conditions of their BNPL agreement to avoid unexpected costs.

Moreover, the availability of BNPL options may vary depending on the dealership or financing institution. Prospective buyers should research and compare different offers to find the one that best suits their needs and financial situation.

Conclusion: Making Electric Cars Accessible

The Buy Now, Pay Later model represents a significant step forward in making electric cars more accessible to a wider audience. By alleviating the immediate financial burden, BNPL encourages more consumers to consider electric vehicles, contributing to a greener future. However, it is essential for buyers to carefully evaluate their options and choose a plan that aligns with their financial capabilities. With the right approach, BNPL can be a highly effective tool in the transition to sustainable transportation.